Strengthening Policy and Support Mechanisms

The most critical step is decisive government intervention through practical, targeted support policies. Premium subsidies, particularly for low-income farmers and strategic crops and livestock, should be increased to ease financial burdens and boost participation. These subsidies must be flexibly adjusted to match the specific risk profiles of each region and commodity.

Expanding the scope of eligible beneficiaries is equally important, moving beyond a limited set of priority commodities to cover a broader range of agricultural products. Strengthening the legal and regulatory framework with clear provisions on the rights and obligations of all parties would help create a transparent, equitable environment, ensuring that agricultural insurance schemes are implemented effectively.

Diversifying Insurance Products and Leveraging Technology

To make agricultural insurance more relevant and farmer-friendly, insurers should diversify and tailor products to local contexts. Beyond complex traditional packages, they could design specialized policies for specific crops and livestock. One promising approach is index-based insurance, which uses objective indicators such as rainfall or temperature to trigger payouts. This model reduces loss-assessment costs, speeds up compensation, and is particularly well-suited to remote and underserved areas.

Technology is also a game-changer in monitoring and assessing risks. Remote sensing and satellite imagery allow for real-time tracking of crop conditions and accurate assessment of post-disaster losses, speeding up and improving the accuracy of claims. Meanwhile, IoT-enabled sensors and automated weather stations deliver timely, localized data, enabling early-warning systems and helping insurers develop more scientifically grounded products.

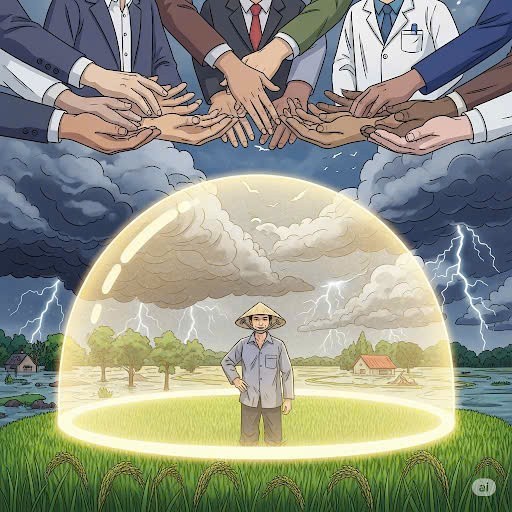

Building Partnerships and Raising Awareness

The success of agricultural insurance depends on a well-connected ecosystem. Stronger collaboration among government agencies, research institutions, agribusinesses, and farmers is essential, supported by regular information exchange to design and deliver effective programs. International organizations should also be encouraged to contribute technical expertise and share best practices, helping Vietnam adopt proven global models.

Equally important is raising awareness among farmers. Multi-channel communication campaigns ranging from local radio and television to community-based training sessions are essential to help farmers fully understand the benefits of agricultural insurance. The development and replication of successful pilot models will offer tangible, evidence-based examples that persuade farmers to actively protect their production.

In summary, agricultural insurance serves as a robust “safeguard mechanism” but unlocking its full potential requires a synchronized and comprehensive set of solutions. From government support policies and technological innovation to strong linkages among all stakeholders, these combined efforts will form a solid foundation for Vietnam’s agricultural sector to overcome the challenges of climate change and move toward a sustainable future.